PUERTO RICO’S MOONSHOT OPPORTUNITY: RECOMMENDATIONS FOR THE U.S. TERRITORY’S ECONOMIC FUTURE

Princeton School of Public and International Affairs Policy Workshop Report

January 2022

Faculty Director

Eduardo Bhatia

John L. Weinberg/Goldman Sachs & Co. Visiting Professor in Public And International Affairs

Authors

Juan Pablo Alvarez Enriquez • Joscelyn Garcia • Karlin Gatton •

Guillermo A. Herrera • Nethaniah Josma • Jia Jun Lee • Ryan Price •

Joshua Seawell • Francis Torres • Andre Zollinger

We are grateful to the many individuals and organizations that contributed their time, knowledge, and effort to aid us in our research. Firstly, we would like to thank our workshop facilitator Eduardo Bhatia for his invaluable instruction and guidance throughout the process of producing this report. We also thank the staff at the Princeton School of Public and International Affairs for their support.

Our work is particularly indebted to local civil society leaders, activists, experts, and elected officials in Puerto Rico, who graciously and enthusiastically supported our research endeavor. We are particularly grateful to the Center for a New Economy for their sustained engagement with our project and for allowing us to present a preview of our report in their 2021 Growth Policy Summit.

The authors would like to thank the following individuals for their contributions:

Pedro Pierluisi, Governor of the Commonwealth of Puerto Rico

José Luis Dalmau, President of the PR Senate

Rafael Hernández, Speaker of the PR House of Representatives

Omar Marrero, Executive Director of the PR Fiscal Agency and Financial Advisory Authority

Francisco Parés Alicea, Secretary of the PR Treasury

Juan Carlos Blanco Urrutia, Director of the PR Office of Management and Budget

Zulma Rovira-Pérez, COR3

Luis M. Collazo Rodríguez, Administrator of the PR Public Employee Retirement System

Julia Nazario Fuentes, Mayor of the Municipality of Loiza

Natalie Jaresko, Executive Director of the Financial Oversight and Management Board

Antonio Weiss, former Counselor to the Secretary of the U.S. Treasury

Kent Hiteshew, former Director of U.S. Treasury’s Office of State and Local Finance

Rosanna Torres, HUD Senior Advisor for Puerto Rico

Sergio Marxuach & Deepak Lamba-Nieves, Center for a New Economy

Cecille Blondet, Daniel Santamaría & María Mercedes Rodríguez Rivera, Espacios Abiertos

Rolando Emmanuelli, Bufete Emmanuelli, C.S.P.

Rafael Arrillaga-Romany, RAR Consulting Group, LLC

Javier Rua-Jovet, JRJ Consultants and Legal Advisors

Jorge Irizarry, Executive Director of Bonistas del Patio

José Coleman & Emiliano Trigo, former officials at the PR Government Development Bank

Javier Balmaceda, Senior Policy Analyst at the Center on Budget and Policy Priorities

Ricardo Cortés, Public Affairs Director at Discover Puerto Rico

John Bozek, Research and Stratregy Director at Invest Puerto Rico

Published January 2022

Members of the workshop team meeting with Puerto Rico Governor Pedro Pierluisi. From left to right: Professor Eduardo Bhatia, Ryan Price, Nethaniah Josma, Juan Pablo Alvarez Enriquez, Joshua Seawell, Gov. Pedro Pierluisi, Francis Torres, Joscelyn Garcia, Andre Zollinger, Jia Jun Lee, Guillermo A. Herrera.

Members of the workshop team meeting with Puerto Rico Governor Pedro Pierluisi. From left to right: Professor Eduardo Bhatia, Ryan Price, Nethaniah Josma, Juan Pablo Alvarez Enriquez, Joshua Seawell, Gov. Pedro Pierluisi, Francis Torres, Joscelyn Garcia, Andre Zollinger, Jia Jun Lee, Guillermo A. Herrera.

Juan Pablo Alvarez Enriquez is a second-year Master in Public Affairs candidate studying International Development. Before Princeton, he worked at the United Nations High Commissioner for Refugees in Mexico where he co-designed and coordinated a local relocation program to integrate refugees into the formal economy.

Joscelyn Garcia is a second-year Master in Public Affairs candidate studying International Development. She previously worked as an administrative associate at World Relief Chicago, working with immigrants, refugees, and asylum seekers.

Karlin Gatton is a second-year Master in Public Affairs candidate studying economics and public policy. She has served as an international affairs fellow at the United States Treasury and a senior analyst at the Federal Reserve Bank of New York.

Guillermo A. Herrera is a second-year Master in Public Affairs candidate studying International Development. Prior to Princeton, he worked as a Project Coordinator at the International Budget Partnership, where he promoted fiscal transparency, accountability, and participation.

Nethaniah Josma is a second-year Master in Public Affairs candidate studying development and urban affairs. Prior to Princeton, she worked for the U.S. Department of the Treasury’s Office of the Comptroller of the Currency as an Associate National Bank Examiner.

Jia Jun Lee is a second-year Master in Public Affairs candidate studying economics and public policy. He previously worked as a research analyst at the World Bank in Washington D.C. and an environmental specialist at the World Bank Indonesia office.

Ryan Price is a second-year Master in Public Affairs student studying international relations. Prior to Princeton, he worked on U.S. climate policy and served in the White House Office of Legislative Affairs during the Obama administration.

Joshua Seawell is a second-year Master in Public Affairs candidate studying Domestic Policy. Before Princeton, he worked as a Research and Policy Associate at the think tank Employ America.

Francis Torres is a second-year Master in Public Affairs candidate studying Domestic Policy. He previously worked as a communications specialist at the Washington Office on Latin America and the Puerto Rico-based think tank Center for a New Economy.

Andre Zollinger is a second-year Master in Public Affairs candidate studying International Development. Before coming to Princeton, he managed a tech incubator in France and consulted for the European Commission on innovation and sustainability.

Circumstances are converging to make this a seminal decade for the people and the government of Puerto Rico. The territory’s Plan of Adjustment is expected to herald in a much lower debt burden for the government. Local officials simultaneously face the challenge of spending more than $50 billion in appropriated federal recovery funds. Used strategically alongside other targeted policy interventions, these measures can give Puerto Rico a unique “moonshot” opportunity to overcome and reverse the concerning trends of the prior decade and grow once again.

The challenges facing Puerto Rico are significant but surmountable. The poverty and labor force participation rates have both held fast in recent years around 45%, making Puerto Rico an economic outlier compared to the rest of the United States. Around one-fifth of residents have migrated out of Puerto Rico in the last decade, leaving an older and less productive population. Years of austerity and high sales tax rates have also limited the government’s ability to raise revenue and spend on public goods and services.

To better understand the challenges and opportunities facing Puerto Rico, we examined these issues and studied the course of Puerto Rico’s debt crisis and the federal response under the PROMESA law. From October 18 to October 22, 2021, we met with nearly 30 prominent stakeholders in Puerto Rico to better understand the various perspectives across the private sector, civil society, government officials and legislators. Our research and interviews convinced us of Puerto Rico’s ability to grow anew with key reforms. While this report does not address every critical challenge for Puerto Rico’s economy, it higlights key areas of concern and puts forth a series of actionable recommendations.

We have structured the report around three main imperatives for Puerto Rico: Build a Better Environment for Fiscal Growth, Ensure a Fair and Robust Public Asistance and Disaster Relief, and Achieve Resilient and Sustainable Growth.

Taking inspiration from Detroit’s successful return to the bond market, our proposed strategy focuses on framing the return to market as a fresh start for Puerto Rico, while remaning cognizant of current market conditions. We also recommend enhancing the stature and authority of the Chief Financial Officer position, reinstituting a Legislative Budget Office and implementing special training programs to build a stronger local civil service.

Parity for federal public assistance programs, namely Medicaid, SNAP, and SSI. HUD and FEMA can provide additional training and knowledge-sharing assistance for local agencies and fund recipients to maximize their use of federal funds, and local disaster recovery agencies should leverage federal funding to create a cross-cutting, publicly accessible open data portal for recovery spending. To ensure the recovery meets the needs of the territory’s most vulnerable communities, we recommend the creation of a framework for civil society to participate in recovery planning and oversee the use of federal disaster funds.

This section focuses on manufacturing, tourism, agriculture and renewable energy. We suggest pathways for Puerto Rico to grow each of these sectors in the coming years. For medical manufacturing, we recommend market research and policies to develop an import substitution strategy. For tourism, we propose research and investments to inform a shift towards high-end experiences such as ecotourism and medical tourism. For agriculture, we encourage consolidation around high-productivity firms as well as reforms to the territory’s land use plan with the goals of increased agricultural production and sustainability.

Puerto Rico should also strengthen the role and capacity of the Puerto Rico Energy Bureau, take advange of federal funding and other financing opportunities to accelerate renewable energy projects, and establish policies to mitigate the distributional impacts of the prosumer model.

Lastly, we recommend continued advocacy to eliminate or scale back the Jones Act shipping restrictions for goods travelling between Puerto Rico and other U.S. ports.

In the middle of the 20th century, Puerto Rico embarked on an industrialization process that paid off with significant growth: Puerto Rico’s GDP grew at an annual average rate of 4.9% during 1950 to 2000. However, from 2000 to 2010, Puerto Rico’s economy dramatically slowed down to a yearly growth rate of 0.7%. In the last decade, the growth rate has been negative, on average at a level of -1.3% .1

The economic growth and subsequent shrinking of Puerto Rico’s economy is tied to its industrial policy. According to the United Nations Economic Commission for Latin America and the Caribbean (ECLAC), the industrialization policy applied in the Caribbean, including Puerto Rico, after the 1940s focused on developing industry through the attraction of foreign direct investment. In other words, “industrialization by invitation.” Puerto Rico was different from the rest of the Caribbean because of its special relationship with the United States (U.S.). As an organized territory of the United States with Commonwealth status, Puerto Rico attracted mainland U.S. companies and “exported” the remaining labor that could not be absorbed in the local economy. Puerto Rico imported capital and exported labor. This strategy was known as “Operation Bootstrap” and involved local infrastructure and social capital investment, tax concessions, grants, subsidized rentals, utility rates and low wage rates.2

Note: Graph based on calculations using World Bank data.

According to ECLAC, “the U.S.-ownership led industrialization strategy of development in Puerto Rico constrained the development of a local industrial class.” Essentially, Puerto Rico skipped the import substitution industrialization (ISI) component of Operation Bootstrap and moved into the export-oriented phase without properly linking foreign investment with the local economy.

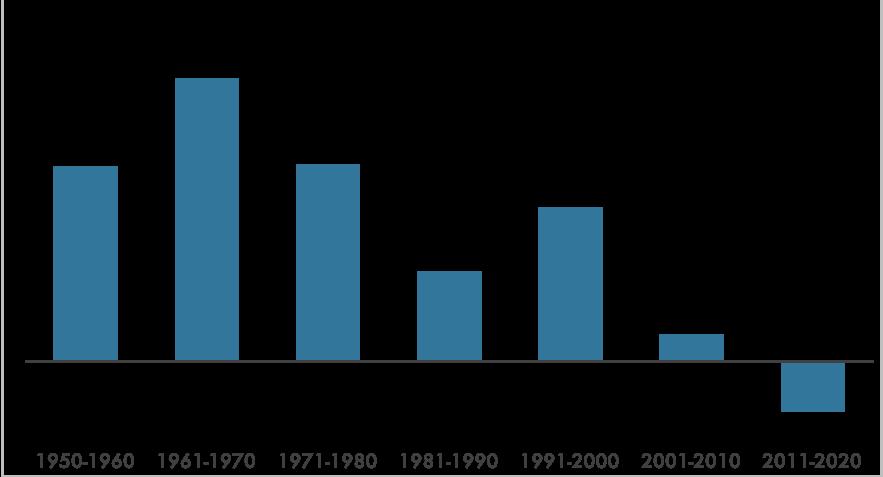

The population on the territory followed a similar path. Puerto Rico’s population has been falling since 2004 due to a decline in birth rates and outmigration, exacerbated by disasters and persistent recessions. Previously, the territory had experienced steady growth following World War II. From 1950 on, the population of 2.2 million increased, peaking around 3.8 million in 2004. By 2020, the population had decreased 18%, down to 3.1 million. More dramatically, the population of Puerto Rico is aging. The median age is 42 years old (40 for men and 43 for women). In comparison, the median age of the U.S. is 38.1 years old. The age dependency ratio in Puerto Rico is 65%, leaving only about 1.02 million people in the labor force. The population decline and increased aging have debilitated the labor force and the capacity for economic growth.

Due to the 1917 Jones Act, Puerto Rico’s bonds are exempt from taxation by the US Government and any State, county, or municipality. This taxation advantage allowed Puerto Rico to raise liquidity regularly. In contrast, Puerto Rico has a considerable disadvantage relative to the 50 States of the Union regarding federal funding for social programs. For example, the federal government currently pays for 76% of Puerto Rico’s Medicaid costs, when the rate would be 83% if the territory was treated as a state. Puerto Rico’s inability to fund social programs and its ease of borrowing money led to an unsustainable level of indebtedness.

Since 2006, Puerto Rico has experienced a string of economic crises, leading to fiscal challenges. The government has had a long history of political disagreement on managing cash flows and funding operating expenses. The government opted to borrow during previous downturns, issuing bonds to access liquidity and sustain government functioning.3 In 2009, credit rating agencies began downgrading revenue bonds issued to the Puerto Rico Highways and Transportation Authority to junk bond status for notable decreases in revenues and increasing operational costs.4 Over the years, further concerns around the heavy indebtedness and economic decline of government agencies led to downgrades of Puerto Rico’s general obligation debt. The government retained access to credit markets and continued to borrow to manage its severe financial difficulties, amassing an unprecedented amount of debt.5

It was not until credit rating agencies downgraded Puerto Rico’s general obligation debts from a “Baa3” to a “Ba2” rating (“junk” status) in 2014 that the government faced public and legal pressure to address its ballooning debt. In 2015, former Governor Garcia Padilla announced a potential default on $73 billion of outstanding debt. This announcement presented the largest impending default in U.S. history and ignited public debates on the territory’s fate because of its inability to file for bankruptcy using the tools under Chapter 9 of the U.S. Bankruptcy Code. (In 1984, the U.S. Congress changed the federal bankruptcy code to preclude territories from filing for protection.) Lacking a mechanism to restructure the debt, the government of Puerto Rico passed local legislation, the Puerto Rico Public Corporation Debt Enforcement and Recovery Act. The U.S. Supreme Court rejected in 2016 the Recovery Act, determining that it violated the U.S. Constitution. The Supreme Court decided that it was only within the power of the U.S. Congress to approve legislation that facilitates bankruptcy procedures.6

The law’s rejection created a dangerous policy gap, further increasing the difficulty presented by the debt crisis. It was evident that Puerto Rico needed a mechanism to reorganize future

debt payments while avoiding costly and unpredictable collection litigation from bondholders. Puerto Rico needed a breather but did not have the power to declare a “stay” under either local or federal law.

Passed by the U.S. Congress on June 1, 2016, the Puerto Rico Oversight, Management and Economic Stability Act (PROMESA) provided the government and other territories with a legal mechanism to default and procure a litigation stay while restructuring its debt.7 The most politically controversial aspect of the legislation mandated a seven-person fiscal oversight and management board (FOMB) appointed by the President of the United States. Puerto Rico lawmakers and politicians insisted on an independent body to oversee negotiations and reconcile the concerns across multiple stakeholders and creditors. Opposition parties have claimed the Board is an obstructive body that impedes the territory’s ability to self-govern and puts significant constraints on public resources. Under Sec. 209 of PROMESA, the FOMB will terminate once Puerto Rico restructures its debt, shows the capacity to access capital markets at reasonable rates, and achieves four consecutive balanced budgets.

The FOMB currently handles the restructuring of the debt and oversees Puerto Rico’s fiscal health. After five years of tense and difficult negotiations between FOMB, creditors, and the Puerto Rico Legislature, the FOMB filed the proposed 8th amended Plan of Adjustment to U.S. District Court Judge Laura Taylor Swain for confirmation on November 5, 2021. At the time of writing, the federal judge had not ruled on the plan. The current plan aims to reduce the $73 billion in outstanding debt to $34 billion, cutting 80 percent of the largest amount of claims against the territory from $33 billion to $7.4 billion. The plan would ensure the government’s maximum debt service payment is $1.15 billion per year. The government must also address $55 billion in pension liabilities.

Puerto Rico is on the heels of a historic debt restructuring agreement that would reduce its debt burden significantly. The series of natural disasters and the COVID-19 pandemic have led to an unprecedented availability of emergency and recovery funds. Never before in recent history has the territory’s fiscal and economic situation been subject to so much attention from financial markets as well as from the federal government. In this unique context, Puerto Rico faces a momentous opportunity to overcome its misfortunes and chart a pathway towards economic prosperity for decades to come.

Our goal in this report is not to revisit past discussions on the territory’s debt, but instead to look to the future and provide a roadmap for all stakeholders interested in the long-term success of Puerto Rico. This report is organized into three sections that address different areas for reform. In Section 1, we examine how Puerto Rico could return to markets effectively and improve the quality of its governance. In Section 2, we call for parity on federal public assistance programs and propose measures to improve the implementation of disaster relief. In Section 3, we explore economic investments that Puerto Rico could make in strategic sectors to drive growth.

We recognize these recommendations are by no means exhaustive and exclude important issues like migration and education. Nonetheless, we hope they can contribute to the consequential debate underway on Puerto Rico’s future.

photo by rj lerich on Shutterstock

photo by rj lerich on Shutterstock

Puerto Rico’s fiscal crisis originated from large fiscal deficits and high borrowing costs. Mitigating and reversing these dynamics will be critical to Puerto Rico’s future success. While the Plan of Adjustment makes significant progress on these goals, it is not sufficient in isolation. For Puerto Rico to realize its moonshot opportunity, the territory should prepare a thoughtful strategy for returning the government to financial markets and implementing governance reforms that support long term fiscal stability and growth.

To generate reasonable fiscal stability in the long run, the government of Puerto Rico will need a strategy for re-accessing capital markets. Under Section 207 of PROMESA, the Federal Oversight and Management Board must certify that Puerto Rico has “adequate access to both short-term and long-term credit markets at reasonable interest rates to meet the borrowing needs of the territorial government.”8 Also in order to exit PROMESA, the government must maintain budgets in accordance with modified accrual accounting for four fiscal years. The Plan of Adjustment, which has already passed the Puerto Rican legislature, addresses the four fiscal years of modified accrual accounting.9

Puerto Rico’s recent fiscal challenges give the territory a unique opportunity and motive to review internal governance practices and promote transparency. Throughout our weeklong trip to the territory, we heard from stakeholders that better governance was a key factor that could help Puerto Rico seize the moment and permanently rebound from bankruptcy. This message was repeated by leaders across the public, civil and private sectors. Interviewees frequently emphasized three components of governance worth focusing on: improved transparency, enhanced institutional capacity, and establishing a common vision. Specifically, we heard the theme of transparency echoed most consistently by private- and public-sector actors during our trip. For example, one prominent stakeholder told us in no uncertain terms: “Transparency is the number one thing that can benefit Puerto Rico.”

Insufficient governance standards and a lack of transparency frequently accompany public debt crises. For example, Greece’s formal debt crisis began with updates to previously misleading financial reports and Mozambique had to make significant cuts to public spending after the “Tuna Bond” disclosures in 2016. Wary investors also demand higher returns in situations of higher perceived risk, which can be created in conditions of lower transparency.10

The recommendations enclosed in this section are more than idealistic proposals to improve abstract notions of good government. Increased transparency can benefit Puerto Rico by assuring future investors, minimizing the cost of borrowing and increasing public trust. Improved institutional capacity and effectiveness would enhance government functioning and economic development.

Regaining market access is uncharted territory for Puerto Rico, thus it is useful to consider the experiences of other entities that have undergone previous restructurings, namely the City of Detroit and Puerto Rico’s own Aqueduct and Sewer Authority (“PRASA”). While neither offers a perfect comparison to Puerto Rico’s general obligation debt—Detroit filed under chapter 9 and PRASA bonds are different from general obligation debt—the lessons for returning to market are instructive despite these differences. A coherent strategy on market access should take into account the lessons learned from these two cases.

Detroit did extremly well in its return to market following its bankruptcy. The City of Detroit filed for bankruptcy in July 2013, with around $18-20 billion in debt, making it the largest municipal debt bankruptcy except for Puerto Rico. Prior to filing for bankruptcy, Detroit had entered a state of emergency and stopped making payments on some of its debt and contributing to its pension system.11 Yields on Detroit’s general obligation bonds increased to nearly 8%. After a series of cases, Michigan’s bankruptcy court approved the City’s request to file under Chapter 9. The Legislature’s Plan of Adjustment included three years of balanced budgets.12 Four years after Michigan’s court approved the Plan of Adjustment, Detroit returned to the bond market.

The messaging from city officials on the bankruptcy process presented Detroit’s new offering as a “fresh start,” which allowed them to enter markets with less overhang from the bankruptcy.13 Detroit did not pay as large of a premium as expected when they returned to the market. In discussing the state’s finances, the Chief Financial Officer emphasized the progress that the city had made since the bankruptcy.14 The authorities also emphasized the requirements under the Plan of Adjustment to right-size the fiscal situation, including the requirement for three years of balanced budgets.

The PRASA issuance is a harbinger for future general obligation issuances in Puerto Rico, and the authorities should lean on this success when other entities return to bond markets. The territory has not been shut completely out of financial markets after the default, as some creditors argued in the early days of the crisis. PRASA is the only Puerto Rican entity to have sought access to financial markets since 2016. Therefore, markets may reference the PRASA issuance as a model for Puerto Rico’s general obligation debt. When PRASA successfully accessed markets in January 2021, the Governor heralded the issuance as “excellent and hopeful news for PRASA.”15 Several local newspapers noted that PRASA’s issuance was one of the chief financial accomplishments of the territory since PROMESA’s approval. At the time of restructuring, PRASA had a stronger financial position than several other state owned entities and did not need or opt to restructure its debt. PRASA had around $4.6 billion in outstanding debt obligations, the second largest of state owned or public corporations in Puerto Rico.16 Though PRASA was spared from the restructuring process, the Authority’s bonds are still rated junk status.

Market timing was critical for both PRASA and Detroit, as they both entered market conditions where investors were looking for yield. In the Detroit case, it is possible that tight financial conditions meant that investors placed less of a premium on bankruptcy. Given that Detroit issued bonds at similar spreads to the comparably rated but solvent Chicago Board of Education, there does not appear to be a heavy market penalty for bankruptcy. Similarly in the PRASA case, one of the reasons the PRASA issuance was so successful was favorable market conditions. Typical investors were searching for yield, particularly in late 2020, so demand for the issuance exceeded its announced size.17

Favorable market conditions means that both the Detroit and PRASA issuances were oversubscribed with demand from institutional investors. Detroit planned to issue $111 million in bonds but increased the size to $135 million due to investor demand.18 Also, final interest rates on the sale were lower than anticipated due to the oversubscription. The yield on bonds due in 2025 was 4.95% with a 5% coupon.19 The spreads on the bonds were also quite narrow compared to a AAA-municipal bond index.

Detroit was similarly fortunate that market conditions supported the issuance. In December 2018, the bond market was “hungry for yield,” and investors were looking for high yield opportunities.20 These tight financial conditions helped contribute to the demand for Detroit’s debt and the subsequent lower interest rate than anticipated. Other actors speculate that market conditions and search for yield led investors to pay less attention to Detroit’s bankruptcy and underlying fundamentals. Beforehand, it is extremely difficult to predict market conditions and time the issuance to a friendly municipal market. While there is no telling what would have happened had Detroit entered the market during less friendly conditions, it is clear that market timing is important for re-entry after bankruptcy.21

In conclusion, based on the experience of Detroit and PRASA, we believe that Puerto Rico’s return to the financial market to be able to borrow again under reasonable rates should be feasible once the final Plan of Adjustment terms are unveiled.

In early March, Puerto Rico’s Governor Pedro Pierluisi signed executive order 202118 establishing the current Chief Financial Officer position and laying out its writ.22 The Governor has identified 24 separate functions and responsibilities for the position, including “centralizing all the functions of financial management, improving governance and fiscal management.”23 The plans for the CFO also include “full coordination” with AAFAF, OMB, the Puerto Rico Information and Technology Services (PRITS), GSA, the Office of the Inspector General and the Government of Puerto Rico Human Resources Administration and Transformation (OATRH). From leading government-wide enterprise resource planning (ERP) to auditing the financial units of agencies, the CFO has significant and varied responsibilities.

These directions vest significant power and authority in the CFO, and his or her success will be directly linked to the fiscal success of Puerto Rico. The creation of the CFO is a smart and prudent response to the fiscal challenges facing Puerto Rico. To the extent that good governance can be institutionalized within a program or office in the government, the CFO fits the bill. Their ownership over previously disparate responsibilities and their mission to bring greater transparency to Puerto Rico’s fiscal affairs represent the sine qua non of good governance. The legislature of Puerto Rico should therefore embrace this new office by providing the authorization and funding necessary for it to succeed. In particular, legislators should consider giving the CFO “the appropriate authorities over financial dependencies that would allow CFO authorities over critical fiscal roles, responsibilities, and processes.”24 The CFO should act to expedite the publication of audited financial statements, as the current three-year lag could harm efforts to regain access to low-cost credit.

Puerto Rico could learn from how Washington, D.C. overcame its fiscal crisis in the 1990s by appointing a Chief Financial Officer. Washington, D.C.’s fiscal challenges began in 1994, exacerbated the recession in the early 1990s and rising entitlement expenditures not covered by the federal government. The District started running fiscal deficits on the order of $70 million, which contributed to a $750 million debt load and high interest rates given its junk bond status. The Clinton Administration expressed concern for the District’s fiscal situation, and instructed Congress to address the situation and avoid a fiscal cliff in Washington. Congress considered several options but settled on a control board authorized under the District of Columbia’s Fiscal Responsibility Act of 1995. The Control Board had five members appointed by the President of the United States and was given the power to override the mayor and D.C. city council.25 The day Congress approved the control board, the mayor of D.C. quipped that it was “a sad day for the city.”26

The Control Board in the Washington, D.C. case exited in 2001, a year earlier than anticipated under the DCFRA. The control board left after Washington had achieved a balanced budget for five fiscal years and the Chief Financial Officer had become the final arbiter on the budget. Under the DCFRA, the Mayor appoints the Chief Financial Officer, but this individual has professional protections enabling them to review the budget without political bias.27 Puerto Rican officials should adopt similarly stringent protections for their CFO, since they have provided in Washington, D.C. “strong re-assurance that these functions are administered with the requisite professionalism and transparency while insulating financial decisions from political influence.”28

A key difference between the Washington, D.C. and Puerto Rico cases is the sunrise provision of the control board. The District of Columbia’s control board included a sunrise provision, so the Board can come back at any time if the District’s fiscal situation deteriorates.29 While in practice D.C.’s control board is unlikely to return due to political unpopularity and the District’s healthy finances, the legal architecture exists for its resurgence.30 Dr. Alice Rivlin, who was the head of the control board in 2001, noted ten years later in 2011, that given the role of the CFO, it is unlikely the District would breach any of the clauses that trigger sunrise.31 Also, several District City Council members over the past twenty years have publicly vowed to not allow for the control board’s return.

Legislators should demonstrate their commitment to restoring the faith of creditors and the public through the local establishment of an agency equivalent to the federal government’s nonpartisan Congressional Budget Office (CBO). An expert bureaucratic agency responsible for estimating the fiscal impact of legislation would show a serious determination to avoid repeating the mistakes that preceded PROMESA. The California Legislative Analyst’s Office (LAO) provides a good model for a parallel state-based agency. “Known for its fiscal and programmatic expertise and nonpartisan analyses of the state budget,” the office reviews budget control measures, publishes special reports, estimates the fiscal consequences of new acts and forecasts revenue and expenditures.32 These activities are essential for any government aspiring to maintain fiscal stability. Precedents exist for this proposal within Puerto Rico and other states. Indeed, Puerto Rico had such an agency in CLAFI, the Legislative Center for Fiscal Analysis and Innovation, and some of these responsibilities have now been centered in the Office of Legislative Services (OSL) following CLAFI’s repeal. CLAFI was approved in 2015 under law 147-2015, and repealed less than 20 months later in 2017 under law 101-2017.

Policymakers must grapple with key design questions for this agency in the unique context of Puerto Rico. These questions include: which legislation should be automatically scored, if any? How much discretion should congressional leaders have over scoring? How can agency personnel be insulated from political pressure and remain nonpartisan? What role would this agency play under the FOMB, and how much deference should the FOMB give to its estimates? Should staff be restricted to static or dynamic scoring? These are questions best answered by officials in Puerto Rico, ideally informed by the guiding principle of financial prudence.

Like the federal CBO, this new agency should make its findings available in a clear, transparent, and accessible manner. The agency’s work would lose much of its efficacy if its estimates were restricted to a small group of close officials. At a minimum, the findings of the agency should be available to all legislators upon request. This would prevent either party from withholding damaging information on the fiscal consequences of particular legislation, while enhancing all legislators’ ability to cast informed votes on the bills coming through both chambers.

The challenges facing government officials in Puerto Rico have rarely been greater, especially at the local level. In response to devastating hurricanes and earthquakes, municipal governments responded appropriately by shifting their resources to addressing urgent disaster-related needs. However, this has come at the expense of other important functions. The government of Puerto Rico should step in by creating a concentrated program to enhance institutional capacity at the territorial and municipal levels.

This program could take the form of a new Institute for Municipal Advancement housed at the University of Puerto Rico or any other serious institution of higher learning. In its early years, a new institute could hold specific trainings focused on capitalizing on the federal funding available to Puerto Rico. The institute would recruit individuals experienced with successful FEMA cost-sharing applications to help train government workers on FEMA’s RFRs and RFAs (Requests for Reimbursements/Advances). Other representatives could be brought in to hold

trainings on CARES Act funding, Community Development Block Grants (CDBGs) and strategies for municipalities to access liquidity to get work underway. This final topic could prove to be especially valuable for municipalities, as it partially explains the significant discrepancy between obligated and disbursed funds to date (~$55 billion).

These trainings would provide information on the most complex intricacies of public assistance applications for FEMA and other agencies. Sessions could cover preliminary damage assessments and the different nuances of applications for specific project categories (e.g. debris removal, emergency protective measures, permanent work). The trainings could also help incentivize the development of a local disaster recovery professional workforce by opening up participant and facilitator roles to private sector consultants for the territory.

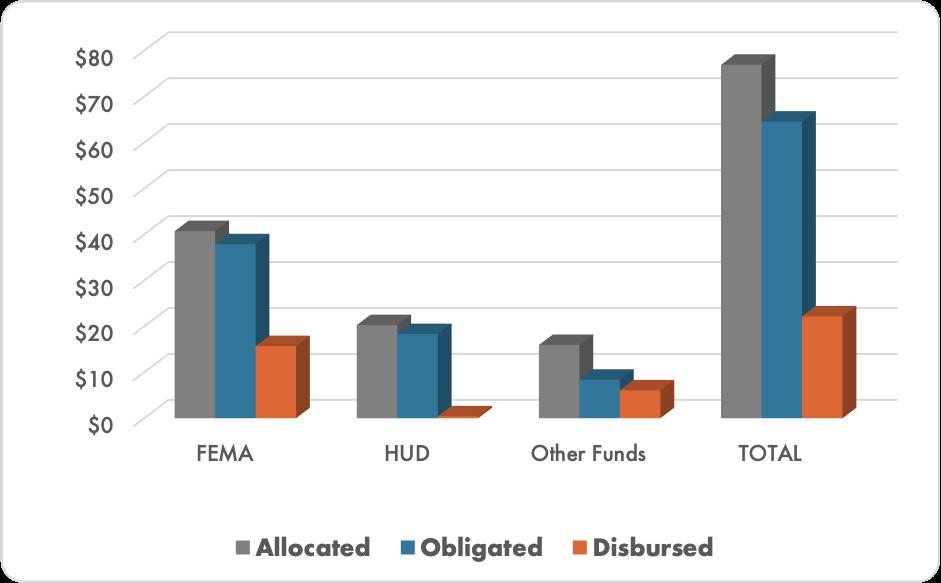

Source: COR3 Transparency Portal

FEMA provides much of its funding via reimbursements. City governments hoping to launch significant recovery projects must therefore access their own liquidity before work can get underway. Puerto Rico’s Fund for Recovery Work helps to alleviate this problem, as it opens up $750 million in advance funding for local governments. The FOMB recently approved the first request to tap into this account. More liquidity should be made available to municipalities to help ensure federal funds do not go unused. The Institute for Municipal Advancement could serve as a good organizing entity for these efforts.

Policymakers should also consider making COR3 its own independent agency. Unfortunately, Puerto Rico will experience more frequent and intense disasters with climate change, including powerful hurricanes. The niche responsibilities of COR3 do not fit cleanly under the Puerto Rico Public-Private Partnerships Authority (P3), its current parent agency. The board of P3 is not as well equipped to review the contracts, consultants and administrative measures of COR3 as an independent board and leadership team could be.

The Puerto Rico Government can request FEMA to provide greater logistical support for aid subrecipients. The agency could then dedicate staff and resources for trainings, workshops, and ongoing support on topics such as Section 428 alternative procedures, best practices in documentation and record-keeping, and other areas of concern for local officials. Given the challenges that subrecipients in Puerto Rico face with the Public Assistance program’s reimbursement system, the agency can also provide guidance on accessing or leveraging other sources of bridge funding, such as CDBG-DR funds or public-private partnerships. Section 2 of this report provides further information on ways the federal government can ensure the fair and expeditious implementation of recovery funding.

The evidence supporting the power of improved governance is clear. Jayuya is a municipality in central Puerto Rico with 330 people per square mile and a total population of about 15,000. Two hours away by car, the capital of San Juan has 7,000 people per square mile and a total population of about 340,000. With around 5% of both the density and the population, Jayuya has somehow managed to secure more than $275 million in obligated FEMA Public Assistance funding, almost twice the $145 million secured by San Juan.33 According to conversations with recovery experts interviewed during research for this report, the explanation for this difference lies in the unique staffing composition of Jayuya. Many of the staff in this small municipal government have worked there for decades, since Hurricane Georges hit the territory in 1998. Following Hurricane Maria, they had the know-how and ability to manage FEMA funding requests and went to work early to gather the necessary documentation to compete for federal funding. This anecdote illustrates the importance of investing in institutional capacity in Puerto Rico and providing attractive incentives to retain civil servants.

The Fiscal Oversight and Management Board is tasked with restoring fiscal stability to Puerto Rico, and Natalie Jaresko, the Executive Director, conveyed to us directly the importance of enhancing human capital across the Puerto Rican government. As of July 2021, FOMB has 93 staff and continues “to hire personnel in key areas related to fiscal plan implementation, monitoring, and reporting.”34 A long-term focus on strengthening human capital in Puerto Rico’s civil service should lead the FOMB to seek placement for many of its knowledgeable personnel within the government following the FOMB’s termination. If FOMB staff instead depart for other opportunities outside of the Puerto Rico civil service, the investment made in those professionals and their training will accrue to entities other than the Puerto Rican government. These placement efforts can begin before the FOMB’s termination with the introduction of a rotational staffing program between the FOMB and key agencies.

This rotational program could take the form of similar secondment programs within the federal government and other agencies. Staff from key agencies (e.g. AAFAF, OMB, COR3) could “rotate on” to service at the FOMB for defined durations, allowing them to gain an in-depth understanding of the FOMB’s approach to Puerto Rico’s fiscal stability. FOMB staff would also “rotate out” to these agencies and others for similar durations. This mutual exposure across the government and FOMB would result in skill building, broaden the exposure of staff and facilitate new professional connections for FOMB personnel. These experiences would also create natural pathways for FOMB staff to find placement in other agencies following their FOMB service or the FOMB’s termination.

The minimum duration for such secondments should be one year. Shorter rotations may not give staff enough time to make meaningful contributions in their placements; by the time staff would

be trained, they would leave. This rotational program may also lessen some of the criticism of the FOMB as an “outside” imposition upon Puerto Rico, as its composition would come to consist partially of bureaucrats from the existing government of Puerto Rico. It would convey a serious commitment to building human capital in the government, as the oversight board would lend its own personnel to the mission. This arrangement constitutes a shared victory for the FOMB, other agencies in the Puerto Rican government and their collective mission.

• Puerto Rican Government Officials should develop a strategy for returning to market that: 1) messages the return to market as a fresh start, and 2) remains cognizant of market conditions.

• Enhance the stature and authority of the Chief Financial Officer of Puerto Rico with legislative authorization.

• Create a nonpartisan Congressional / Legislative Budget Office to score legislation at the request of Congressional leaders or the Governor.

• Build a stronger civil service through training programs and FOMB rotational staffing.

Like any U.S. state and territory, Puerto Rico relies on the federal government to finance a wide array of public services, especially its social safety net and measures for disaster relief. However, the quality and effectiveness of these programs have been undermined by unequal access to funding, discriminatory application of onerous bureaucratic procedures, and weak local implementation capacity. This was made starkly clear in 2017 when Hurricanes Irma and María devastated Puerto Rico. Although the federal government allocated large sums in disaster relief, the funds were slow to reach victims and support rebuilding efforts. Likewise, people whose livelihoods were severely harmed could not receive nutrition assistance, healthcare, or cash assistance that would otherwise be made available to them in the mainland.

Realizing Puerto Rico’s moonshot opportunity requires removing these disparities and fortifying federal public assistance and disaster relief. A robust safety net would ease the hardships of vulnerable communities like low-income people, people with disabilities, and the elderly, and enable them to lead more prosperous and dignified lives. Effective disaster relief would maximize the $77 billion that has been allocated to rebuild Puerto Rico into a thriving and secure economy.

As a U.S. territory, Puerto Rico participates in certain federal programs in a manner distinct from the states. The most significant programs that involve special arrangements are Medicaid, Supplemental Nutrition Assistance Program (SNAP), and Supplemental Security Income (SSI). Generally, Puerto Rico’s versions of these programs are inferior to those found in the states. These federal programs are critical components of the public safety net, meaning Puerto Ricans are relatively deprived of essential forms of public assistance, especially during times of crisis.

Federal lawmakers are aware that current funding levels for these programs are inadequate and have enacted additional support to salvage them multiple times. The poorer quality of these programs, combined with the lack of predictability on funding, severely constrains Puerto Rico’s ability to respond to the needs of its people. It also limits Puerto Rico’s tools for disaster relief, which are only becoming more important due to climate change.

Medicaid was created in 1965 as a public health insurance program for low-income people. It is funded jointly by federal and state (and territory) governments and administered by states subject to federal guidelines. This structure means eligibility and benefits can vary considerably depending on the state or territory.

Generally, the federal government pays for at least half of Medicaid costs in states and territories, but it could cover as much as 83 percent of total costs by law. The percentage that the federal government pays — known formally as the Federal Medical Assistance Percentages (FMAP) — is determined by the average per capita income of a state relative to the national average. However, in the case of territories, the FMAP is statutorily set at 55 percent (prior to 2011, it was 50 percent), regardless of their per capita income levels. If Puerto Rico were treated as a state, its FMAP would instead be the maximum rate of 83 percent. Another important distinction from states is that federal funding for U.S. territories is provided through a block grant, meaning it’s capped at a certain amount independent of the legal FMAP.

These two policies dramatically shortchange the amount of federal funding that territories receive for Medicaid. In 2019 the base block grant funding that Puerto Rico received was about $370 million, even though the total Medicaid expenditure in the territory was $2.8 billion.35 During 2015 to 2019, the base block grant only covered, on average, 13.9 percent of Puerto’s Rico’s total Medicaid costs – far below the statutory FMAP. Supplementary federal funding has raised the current federal contribution to 76 percent, though.

In Puerto Rico, where about 44 percent of the population lives in poverty, eligibility and benefits are more limited than for states. Income eligibility for Medicaid in Puerto Rico is determined by its own poverty rate, not the federal one, which is much lower.36 As a result, many people who would be eligible in the mainland are not on the territory. In terms of quality of care, Puerto Rico’s Medicaid does not cover seven of the 17 services that states are required to provide by federal law. These include care in nursing homes, home health services, non-emergency medical transportation, and the full range of benefits for children that are guaranteed by Medicaid’s Early and Periodic Screening, Diagnostic, and Treatment benefit. Fewer prescription drugs are covered as well because Puerto Rico does not participate in the Medicaid Drug Rebate Program.37

Due to the inadequacy of Puerto Rico’s Medicaid funding and the string of crises it has faced, Congress has provided multiple rounds of additional Medicaid funding since 2011. The most significant temporary change happened after Hurricanes Maria and Irma, when Congress provided an extra $4.8 billion for 2018 and 2019, and increased the FMAP to 100 percent. In 2019, Congress again extended Medicaid funding through 2021 and lowered the FMAP to 76 percent. Note, these cash infusions were designed to support the existing Medicaid program in Puerto Rico, without changes to eligibility or benefits. For the past decade, the territory has been on a constant fiscal cliff to afford its relatively meager version due to its special treatment.38

Congressional lawmakers broadly agree that Puerto Rico’s Medicaid situation is unsustainable

and requires longer-term solutions, but they have been unable to arrive at a decision. The most recent bill on this issue is H.R. 4406, the Supporting Medicaid in the U.S. Territories Act of 2021, introduced on a bipartisan basis in July 2021 to provide more short-term relief. The bill would essentially extend current federal funding for Puerto Rico for five years (about $2.8 billion annually, unadjusted for inflation) and for other territories for eight years. The FMAP for Puerto Rico would be kept at 76 percent and for other territories it would be 83 percent.39 While this measure would provide needed long-term funding to Puerto Rico, it would still preserve a fundamentally disadvantageous arrangement for Puerto Rico and other territories.40 Puerto Rico’s Medicaid FMAP would still be artificially lower than needed, eligibility would still be stricter, and coverage would still be inferior.

Puerto Rico should have full parity in terms of funding and coverage with states to increase access to healthcare for the most vulnerable communities. This would reduce the fiscal pressure on Puerto Rico and allow it to better weather future crises, as people would automatically qualify for Medicaid if needed.

The Nutrition Assistance Program (NAP) helps low-income people in Puerto Rico put food on their table. It is equivalent to SNAP, which is the nutrition assistance program available in the 50 states of the U.S., the District of Columbia (D.C.) and some territories. However, as with Medicaid, the major difference is that NAP is financed through a federal block grant, whereas SNAP funding is determined by eligibility and has no spending caps.

The NAP is administered by Puerto Rico’s Department of Family Socioeconomic Development (ADSEF in Spanish). Each year, the ADSEF must submit for approval a Plan of Operations to the U.S. Department of Agriculture’s Food and Nutrition Service (FNS), which outlines how benefits will be distributed within federal funding caps and guidelines.41

Eligibility is determined based on the net income of households. For example, a family of three must have a net monthly income below $1,706 to qualify. NAP is one of the largest sources of federal funds to Puerto Rico. The total amount of the NAP grant in FY 2021 is $2.03 billion.42

The NAP provides essential support to low-income and vulnerable communities in Puerto Rico. About a third of the population experiences food insecurity and nearly half receives NAP benefits, according to official government statistics. 43 Among recipients, 32 percent are elderly or people with disabilities and 25 percent are children. Further, 65 percent of them have monthly incomes below half of the federal poverty line. Despite this need, NAP assistance is quite modest — the maximum monthly benefit for a family of three, for instance, is $315. Benefits vary by household size, income, and other characteristics. Households with elderly individuals receive a 20 percent boost in NAP. Although it would not universally be the case, most recipient households would likely receive higher benefits under SNAP.

As with Medicaid, the federal government has allocated multiple rounds of additional funding for NAP, particularly in response to crises. Prior to hurricanes Maria and Irma

in 2017, the net monthly income limit was originally $599 per month. Afterwards, the government provided an additional $1.27 billion, which allowed the income limit to rise to $1,606 and for the max benefit to rise to $511. Importantly, this funding was approved in October 2017, but was not disbursed until five months later in February 2018 because the USDA had required Puerto Rico to deliver a comprehensive Plan of Operation beforehand. Since then, the federal government has provided another $800 million to sustain NAP for disaster and COVID relief, although the max benefit fell back down to $315. 44

The recent cash infusions in NAP reveal a major limitation of the program: it is not equipped to respond to disasters like SNAP. During recessions or disasters, SNAP enrollment automatically increases to support those affected and newly eligible. For instance, the Virgin territory participates in SNAP and was able to provide assistance through the Disaster SNAP program just 47 days after the 2017 hurricanes. In contrast, the NAP has limited funding that prevents it from adjusting unless Puerto Rico or the U.S. government step in. Even if Congress enacts additional funding, delays arise from Puerto Rico having to develop a new Plan of Operation. Overall, transitioning Puerto Rico to SNAP would both provide greater assistance to low-income people and provide a critical lifeline to future victims of disasters.

In recognition of this problem, there have been multiple legislative proposals to transition NAP into SNAP. Most recently, the Puerto Rico Nutrition Assistance Fairness Act was introduced in September 2021 and would transition NAP to SNAP using the assistance of an advisory board. 45 At the same time, there have been proposals to cut back on SNAP eligibility. In 2018, the Fiscal Oversight and Management Board (FOMB) for Puerto Rico called for Puerto Rico to implement work requirements to NAP, such that recipients would need to work for a minimum of 80 hours per month, based on the notion that the program disincentives work. 46

The NAP is a lifeline to low-income Puerto Ricans, but its reach and impact is unfairly limited. Work requirements would be a misguided approach and disqualify many informal workers from nutrition assistance at a time of insufficient demand for formal labor. Ample research has shown that work requirements are ineffective and do not incentivize work. 47 The optimal approach would be to grant Puerto Rico SNAP.

Few programs reflect how deeply Puerto Rico is shortchanged by the federal government than Aid to the Aged, Blind, and Disabled (AADB). AADB is a cash transfer program for lowincome people who are (as implied by the name) elderly, blind, or disabled. It is Puerto Rico’s equivalent of the Supplemental Security Income (SSI) program available in the mainland, except the benefits are significantly lower and eligibility is slightly more limited.

The AADB offers a maximum basic benefit of $64 per month and a secondary benefit equal to 50 percent of actual shelter costs up to $100 per month. By comparison, SSI’s maximum monthly benefit in 2021 is $794, and many states supplement this amount. Both programs have similar eligibility rules. To qualify, recipients need to have less than $2,000 in assets. Importantly, AABD does not raise this limit to $3,000 for married couples like SSI, which

effectively acts as a marriage penalty.

With regard to income, AADB and SSI exempt the first $25 of unearned income per month (like Social Security benefits or pensions) as well as the first $65 of earned income per month. Beyond these low thresholds, the benefit falls by about $0.50 for every dollar of earned income. Because the income limitations are so strict, few people receive the maximum benefit in either program. The average AADB was just $75 per month in 2015 and the average monthly SSI benefit was $580 in 2020. Lastly, children under age 18 are ineligible for AADB, unlike SSI, which is the only direct income support for children with disabilities.48

To place AADB into context, it is important to note that SSI is already a very strict and modest program.

Nearly 9 in 10 recipients are eligible due to a severe disability, based on rigid medical criteria.49 Because of this, almost half of SSI applicants are rejected for medical reasons. In addition, over half of SSI recipients report having no additional source of income besides SSI. The max SSI benefit, which few receive, represents three-fourths of the federal poverty line for an individual.50

AADB is administered by ADSEF and funded through a combination of federal and local money. Namely, the federal government funds 75 percent of the program and 50 percent of the administrative costs. Puerto Rico receives its federal funds in the form of a block grant worth about $36 million (not indexed for inflation) reserved for adult assistance, foster care, adoption assistance, and AADB.51 By comparison, SSI is fully funded by the federal government’s general revenues and administered by the Social Security Administration (SSA). According to the Government Accountability Office (GAO), the federal government in 2011 spent less than 2 percent on AADB relative to what it would have spent if Puerto Rico received SSI.52

States have the option to supplement the federal SSI benefits, many of which do.

Forty-six states and D.C. provide additional assistance, although the amount and eligibility requirements vary widely. For instance, California offers independent elderly individuals an extra $160 per month, while D.C. offers adults living in foster care homes an extra $640 or

Medicaid Effective federal match rate of 76 percent, inferior coverage for medical servicxes and drugs

SNAP Max base benfit of $315 per month for a family

SSI Max base benefit of $64, with 76 percent of costs covered by the federal government

Federal match rate of 83 percent

Max base benefit of $505 per month for a family of three

Max base benefit of $794, fully funded by the federal government

more.53

The amount that Puerto Rico is forced to contribute to AADB is money that could instead be used to increase support for the disproportionately high number of people with disabilities in the territory. About 14.9 percent of its adult residents have a disability, compared to 8.6 percent of the general U.S. population, per the U.S. Census Bureau estimates for 2019.54 That amounts to roughly 476,000 adults, even though only 20,000 adults received AABD in 2015 (the latest year available).55 If Puerto Rico received SSI, its average monthly participants would climb from 34,401 to 354,000 in 2011, per the GAO.56

The fate of AADB is presently in limbo. In November 2021, the Supreme Court heard oral arguments on a case that could oblige the U.S. government to transition Puerto Rico (and other territories on AADB) to SSI.57 Regardless of the outcome of the trial, AADB should be converted to SSI. It represents a profound inequity in how some of the most vulnerable people in Puerto Rico are treated by the federal government.

Since 2017, Puerto Rico has experienced devastating natural disasters that have caused unprecedented damage and complicated the ongoing bankruptcy process. These historic disasters, including Hurricanes Irma and María, as well as a series of earthquakes and aftershocks in early 2020, threatened Puerto Rico’s long-term economic viability even before the impact of the Covid-19 pandemic.

Due to these events, federal recovery, reconstruction, and resilience funding makes up a significant portion of the federal assistance that Puerto Rico will receive in coming years. As of November 22, 2021, Congress had appropriated a total of $76.73 billion in funds for Puerto Rico’s recovery efforts. Of those, $64.18 billion have already been obligated by federal agencies.58 However, these essential recovery funds have taken much longer than anticipated to reach the territory—largely due to onerous approval processes and bureaucratic obstacles that federal agencies forced on Puerto Rico early in the recovery.59 This unequal treatment greatly exacerbated the impact of the natural disasters, compromising the territory’s economy in the middle of its debt restructuring. Though the Biden Administration has taken steps to speed up disbursement and eliminate many bureaucratic barriers, the damage caused by unequal treatment earlier in the recovery still persists.

At this critical juncture for both Puerto Rico’s recovery and debt restructuring process, the territory and the federal government must make key reforms to ensure that the remaining disaster funding is disbursed expeditiously, transparently, and in a manner that centers the needs of the territory’s most vulnerable populations. The following section includes an overview of key federal programs for Puerto Rico’s recovery, highlights concerns with implementation, and proposes recommendations to achieve a more resilient and equitable recovery process.

MORE THAN FIVE YEARS AFTER HURRICANE MARÍA MADE LANDFALL, ONLY 29% OF ALL ASSIGNED FUNDS HAVE ACTUALLY BEEN DISBURSED TO RECIPIENTS IN PUERTO RICO.60

Two federal agencies, the Federal Emergency Management Agency (FEMA) and the Department of Housing and Urban Development (HUD), manage most of the funding for Puerto Rico’s disaster recovery. At the local level, FEMA funding is channeled through the Puerto Rico Central Office of Recovery, Reconstruction and Resiliency (COR3) while HUD programs operate through the Puerto Rico Department of Housing (PRDOH). Though these agencies manage multiple federal disaster relief programs, our analysis and recommendations focus on FEMA’s Individual Assistance and Public Assistance programs, and HUD’s Community Development Block Grant - Disaster Relief (CDBG-DR) program.

In Puerto Rico’s case, FEMA Individual Assistance provides funds to individuals and families who have sustained losses due to disasters, while Public Assistance principally provides grants for “subrecipient” entities such as municipalities or NGOs to permanently restore community infrastructure. At time of writing, FEMA had approved $1.5 billion in Individual Assistance spending in Puerto Rico, and obligated $25.6 billion in Public Assistance funding.61

HUD’s CDBG-DR program provides support for a broad range of long-term disaster recovery activities, including housing redevelopment, infrastructure investments, and economic revitalization of impacted communities. For an activity to receive CDBG-DR funding, it must meet one of three objectives: (1) primarily benefit low-and moderate-income (LMI) individuals and communities, (2) respond to an urgent need, or (3) prevent slums and blight. These grants also have a “targeting requirement” that requires grantees to ensure that at least 70% of funds benefit LMI individuals and communities.62 Following Hurricanes Irma and Maria, Congress

provided an allocation of $20.2 billion in CDBG-DR assistance for Puerto Rico.63

Despite the historic amount of federal funding available to Puerto Rico, the territory’s recovery has suffered greatly from slow action, burdensome requirements, and a lack of consideration for local conditions and processes.

Puerto Rico’s large stock of informal housing led to one of the earliest flashpoint issues for FEMA funding. Despite the fact that approximately half of the territory’s homes and commercial buildings were constructed without building permits or following land use codes, Individual Assistance grants for housing repairs initially required formal proof of ownership for applicants to receive funding. Predictably, FEMA’s disregard for local housing conditions slowed initial disbursement and led to an unusually high percentage of denied applications for housing repair aid.64

In 2018, FEMA started allowing Individual Assistance applicants to submit a signed selfdeclaration of ownership in lieu of formal documentation. However, as of July 21, 2021, only 232,429 of 1,126,413 applicants—just over 20%—had received housing repair or replacement assistance.65 Two thirds of those who were able to access funds received awards of less than $3,000.66

There have also been delays in permanent restorations through FEMA’s Public Assistance program. On October 30, 2017, the Puerto Rico Government agreed to use alternative procedures under Section 428 of the Stafford Act for all large permanent work projects funded through Public Assistance—the only state or territory that has ever done so.67 The alternative procedure allows subrecipients to restore and improve facilities beyond their pre-hurricane condition. However, the program involves significant risk, as Puerto Rico’s government must reach cost estimate agreements with FEMA, and cover any cost overruns. This serves as a risk mitigation strategy for the federal government, limiting its exposure to additional costs while shifting the burden to a local government undergoing bankruptcy.

Additionally, since Public Assistance functions on a reimbursement basis, Puerto Rico’s precarious fiscal condition has made it difficult for government agencies, instrumentalities, and other subrecipients to access the bridge funding needed to start permanent restoration projects under the program. As of January 15, 2021, Puerto Rico and FEMA were still working on cost agreements for around 6,100 more projects - the first stage in order to be able to obligate Public Assistance funds. At that time, the territory had only spent less than 1% of its $17.5 billion PA obligation to reimburse subrecipients for permanent work projects.68

Puerto Rico faced even greater obstacles and onerous restrictions for accessing HUD’s CDBGDR funds.

Under the original allocation, the territory had to apply for grants in increments through a tranche structure and submit its grant notices to a HUD-appointed Federal Financial Monitor for review. During the Trump administration, the Office of Management and Budget (OMB) also required HUD to submit Puerto Rico’s grant notices to an unprecedented interagency review

process, while also pushing Puerto Rico to implement new property management systems and even alter its minimum wage requirements on federal contracts as preconditions for accessing the funds.69

Under current Secretary Marcia Fudge, HUD has now removed these onerous conditions and renewed its commitment to an expedient and equitable recovery70, but bureaucratic delays and conditions early in the process exacerbated the impact of natural disasters in Puerto Rico and increased the vulnerability of the populations that the federal program is meant to serve. For example, PRDOH’s Home Repair, Reconstruction, or Relocation (R3) Program, the main housing assistance program using CDBG-DR funds in Puerto Rico, had only rebuilt 6% of qualifying homes as of June 2021.71

THERE ARE ALSO SIGNIFICANT ONGOING DISPARITIES IN CONTRACTING USING CDBG-DR FUNDS— 36% OF THE TOTAL VALUE OF DISBURSED CDBG-DR FUNDING FOR RECONSTRUCTION PROJECTS HAS GONE TO PUERTO RICO-BASED CONTRACTORS, VERSUS 63% FOR US-BASED CONTRACTORS.72

This inequity goes against the spirit of the Housing And Urban Development Act of 1968, which requires recipients of HUD assistance to contract with local businesses that provide economic opportunities to low-income persons to the greatest extent possible.73 In the case of Puerto Rico’s recovery, this inequity in contracting represents a risk that large off-territory contractors will capture a significant amount of the economic benefit from disaster relief funds.

Puerto Rico’s recovery will require the coordination and timely execution of thousands of complex projects, and yet the territory still confronts a systemic lack of expertise and capacity among government officials, aid recipients, and its disaster recovery workforce. It is not enough for the federal agencies to simply undo harmful policy—they must take proactive steps to set up Puerto Rico for success. We identified ways in which the Puerto Rico government can build technical capacity to use federal disaster funding in Section 1. Additionally federal agencies can make strategic investments to ensure the success of recovery initiatives on the territory.

HUD can facilitate horizontal learning between the PRDOH and other CDBG-DR recipients through workshops and educational forums. It can also directly provide assistance on the ground by rotating high-level career staff to the local Puerto Rico office as a resource to PRDOH and local grantees—a strategy that the agency has taken in other disaster recoveries.

74 The Urban Institute notes that a more proactive HUD can guide grantees in incorporating best practices in data use and transparency, help entities formulate comprehensive strategies and/or collaborate with private or non-profit actors, and leverage CDBG funds for additional funding.

75 HUD’s recent creation of a Special Advisor for Puerto Rico position is an encouraging step in the right direction; the agency should continue to build out a dedicated, cultually competent and bilingual team to share best practices with the PRDOH and local CDBG grant recipients, as well as coordinate with other federal and local agencies involved in the reconstruction.

At the moment of writing, there is no consolidated open data portal through which the general public can access information on all federal recovery funding flows and ongoing projects. Puerto Rico’s recovery and reconstruction plans—as well as updates, amendments, and public comments—are spread out across at least three documents: COR3’s Economic and Disaster Recovery Plan, PRDOH’s CDBG-DR Action Plan, and the Fiscal Plan. Instead of such a piecemeal approach, Puerto Rico’s disaster management agencies and central government can leverage federal funding to develop a comprehensive open data portal for all disaster recovery, reconstruction and resiliency spending. Such a portal should include data on all large projects, including program design and evaluation metrics, progress assessments for subgrantees, and thorough monitoring of contracting trends, among other metrics. It must also be fully bilingual, as only 23.4% of Puerto Rico’s population describes themselves as speaking English “very well.” In such a context, the lack of Spanish-language resources constitutes a serious barrier to an equitable and fully participatory disaster recovery process.76

This tool for greater transparency can also help address the ongoing inequity in procurement between local and off-territory contractors. Local stakeholders have criticized PRDOH’s website and informational services for making it difficult to identify and learn about new procurement opportunities.77 PRDOH, COR3, and their subgrantee agencies can implement e-procurement best practices such as using the open data portal to publish procurement information and make it accessible to all stakeholders.

Puerto Rico also needs a forum for robust community engagement that allows non-government stakeholders to keep an outside eye on the federal funds flowing into the territory. This framework should be inclusive of Puerto Rican civil society, empowering local experts and affected communities to provide oversight for the use of public funds. Two existing proposals are particularly well suited to this task: FEMA’s Whole Community Approach, used in several past disaster recoveries, and the Center for a New Economy’s Civic Committee for Transparency and Reconstruction.78

The Whole Community Approach is built on three main principles — “understanding and meeting the actual needs of the affected communities, engaging and empowering all parts of the community, and strengthening what works well in communities on a daily basis.” Under this framework, disaster management agencies empower community leaders and civil society organizations to establish funding priorities, help implement programs, and evaluate outcomes. The Civic Committee for Transparency and Reconstruction proposal builds on this idea further by establishing a formal committee of nonpartisan issue experts and civil society representatives. The committee could provide independent audits of COR3, PRDOH, and other local agencies involved in the disaster recovery. The purpose should not be to add another hurdle to the disbursement of funds, but rather to ensure that government agencies engage seriously with civil society input on the recovery process and use it to inform policy-making at the local and federal government levels.

Such a body could help keep local agencies accountable to the communities they serve by

providing public updates of any misuse of funds. They could also serve as partners to Congress and federal agencies by ensuring that aid recipients are meeting statutory goals of hiring locally and addressing the needs of low-income communities. Local oversight will also help build the local capacity needed to shepherd the recovery process to a successful conclusion.

Public Assistance

• Parity for federal public assistance, namely Medicaid, SNAP, and SSI.

Disaster Recovery

• HUD and FEMA to provide additional assistance for local agencies and federal fund recipients.

• PRDOH and COR3 to leverage federal funding to create a cross-cutting, publicly accessible open data portal for recovery spending.

• Puerto Rico Government to create a framework for civil society to participate in recovery planning and oversee the use of federal disaster funds.

photo by Wenhao Ryan on Unsplash

photo by Wenhao Ryan on Unsplash

While the Plan of Adjustment represents an important step towards Puerto Rico’s fiscal solvency, it alone will not set Puerto Rico on a sustainable fiscal path. FOMB analysis suggests that the country will return to budget deficits by 2036. Climate change vulnerability, increasing debt service, mercurial decisions from Washington, and the potential of future economic shocks loom large in the territory’s fiscal future.

To avoid a repeat of the debt crisis, the territory will need greater economic growth. Fortunately, the restructuring will restore business investment and municipal access to capital markets. Moreover, suspended debt service has improved the cash balance in Puerto Rico’s accounts. Finally, an influx of federal funds for hurricane recovery, energy development, public assistance and infrastructure will buoy the territory’s fiscal position. The convergence of these conditions provide a once-in-a-generation opportunity for the territory to move its economy forward.

Puerto Rico has several competitive advantages, including market integration with the U.S., preferential federal tax rates under its current political status, a bilingual population and public infrastructure. But the economy still needs extensive coordination to develop healthy and competitive markets. Puerto Rico must think strategically about its comparative advantages in order to invest in winning markets and firms. It must create the conditions necessary to attract dynamic businesses through improved electricity, infrastructure and governance. It must create private sector jobs that workers want, alleviating pressure on the public sector and shadow economy. This section analyzes the economic issues facing Puerto Rico and proposes solutions to revitalize growth.

We identify the following major challenges to growth in Puerto Rico:

1) An expensive, unreliable and inefficient energy sector that raises costs for the whole territory.

2) A weak demand environment due to entrenched poverty, a shrinking population, and years of economic contraction.

3) A large informal economy due to a weak demand environment and poorly designed income support programs.

4) A relatively undiversified economy that depends heavily on foreign manufacturing investment.

5) A decreasing number of children and youth for future human capital and economic growth.

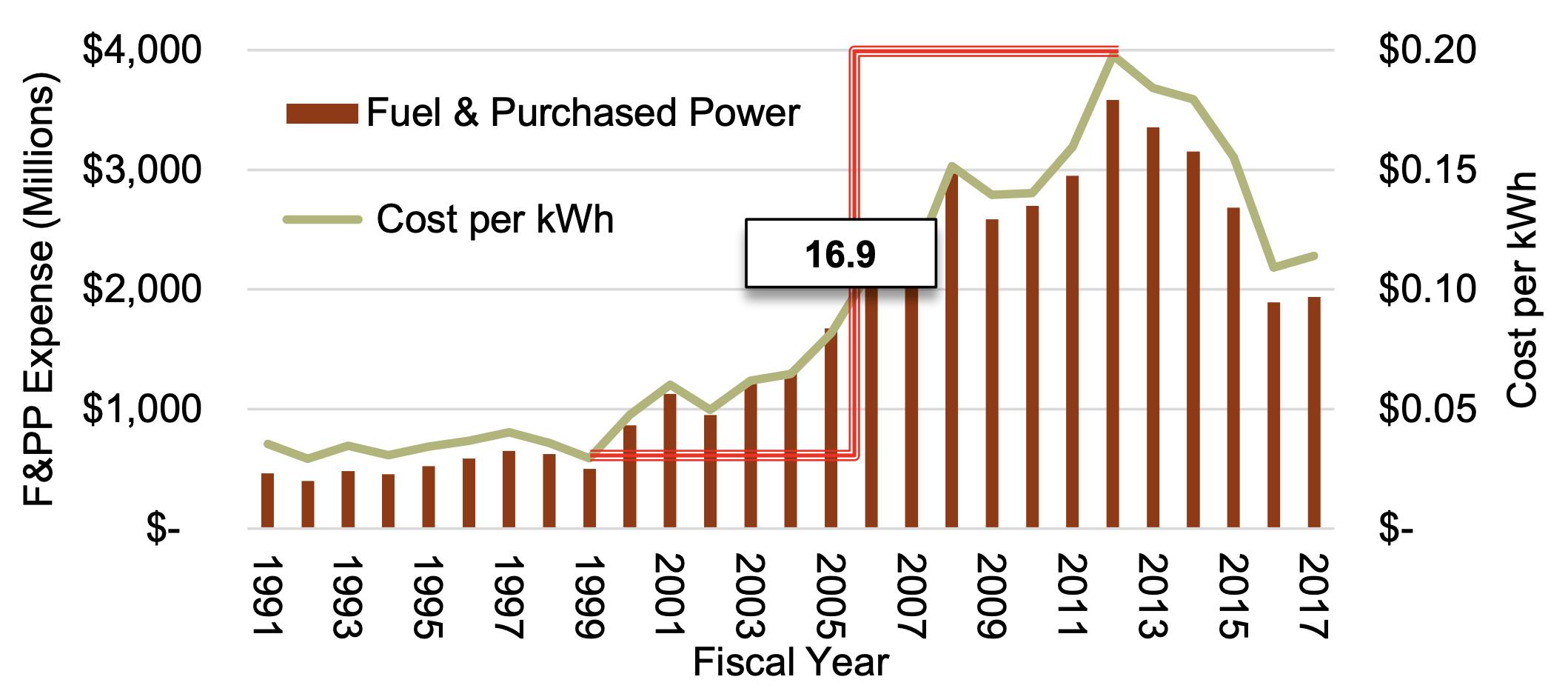

Expensive and unreliable energy has been a longstanding issue for decades in Puerto Rico, even before the Puerto Rico Electric Power Authority’s (PREPA) debt restructuring process further increased electricity tariffs. Residential users pay almost twice as much for electricity as U.S. mainland customers on average.79 In 2019, Puerto Rico’s average price of electricity for residential use was higher than rates in 45 of the 50 states80, while energy contributes up to 30 percent of commercial businesses’ operating costs.81 At the same time, the per capita income in Puerto Rico is half that of Mississippi, the poorest state in the US. To repay bondholders who had a first claim on Puerto Rico’s Electric Power Authority’s (PREPA) general obligation (GO) bonds, residents faced a further 13 percent spike in electricity costs in 2019. With the concession of the transmission system to LUMA Energy through a public-private partnership, these rates might continue to rise to repay bondholders and reduce PREPA’s outstanding debts. Several demand and supply-side factors contributed to Puerto Rico’s high energy costs. Puerto Rico’s population has been shrinking, with a 3.9 percent decline in 2018 itself, and its total population dropping by 632,000 since its peak of 3.8 million in 2004.82 With population decline, PREPA faced a decreasing revenue base and an obligation to provide power for its remaining citizens. To cover the high costs of electricity supply, PREPA charged consumers higher tariffs even while decreasing service.

Puerto Rico Electric Power Authority

Second, PREPA was reliant on an expensive and environmentally corrosive fossil fuel importation scheme to power its outdated and inefficient generators. Petroleum-fired power plants generated almost half of the territory’s total electricity as of 2020.84 The remaining sources of electricity generation come from imported natural gas (29 percent), coal (19 percent) and renewables (less than 3 percent). More than 90 percent of electricity generation is powered by imported fossil fuels, which make energy both costly and subject to volatile world commodity prices (see Figure 6 below). The cost of transporting petroleum and natural gas from the U.S. is extremely high for Puerto Rico given that they must use US shipping companies under the Jones Act. Furthermore, generation power plants in Puerto Rico are outdated, large, and inefficient. The territory’s four large fossil fuel-intensive power plants were built in the 1960s and 1970s and have mostly not been updated since. The power plants are also interconnected in a single centralized grid, making the entire supply vulnerable to any isolated system failures.